Child Tax Credit 2024 Increase Form – If you have a child — even one that was born in 2023 — you may be eligible for the child tax credit. If you qualify, the credit could reduce how much you owe on your taxes. As of right now, only a . Property Tax Rebate the additional child tax credit (ACTC). Families who are low-income or who, for some reason, had no income in the tax year 2023 may feel hard-pressed by not being able to .

Child Tax Credit 2024 Increase Form

Source : www.sarkariexam.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Money Instructor

Source : m.facebook.com

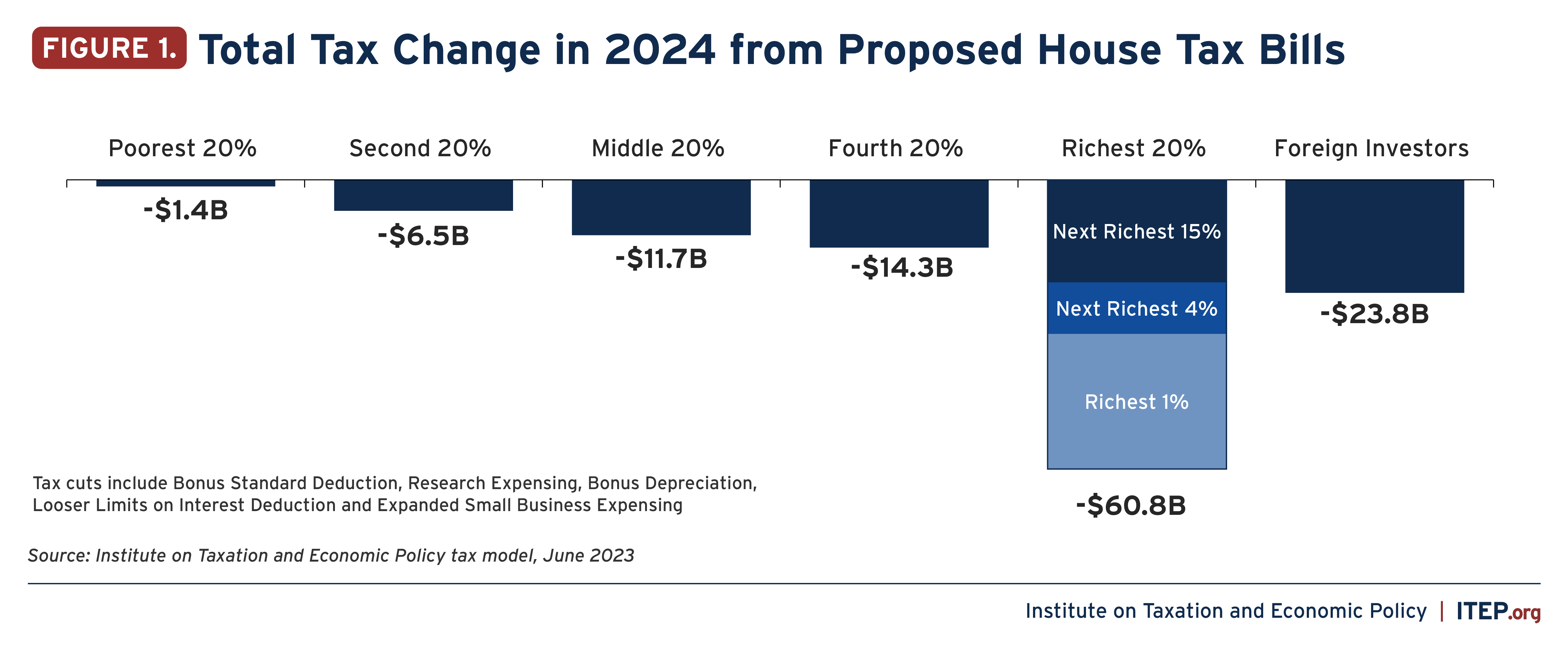

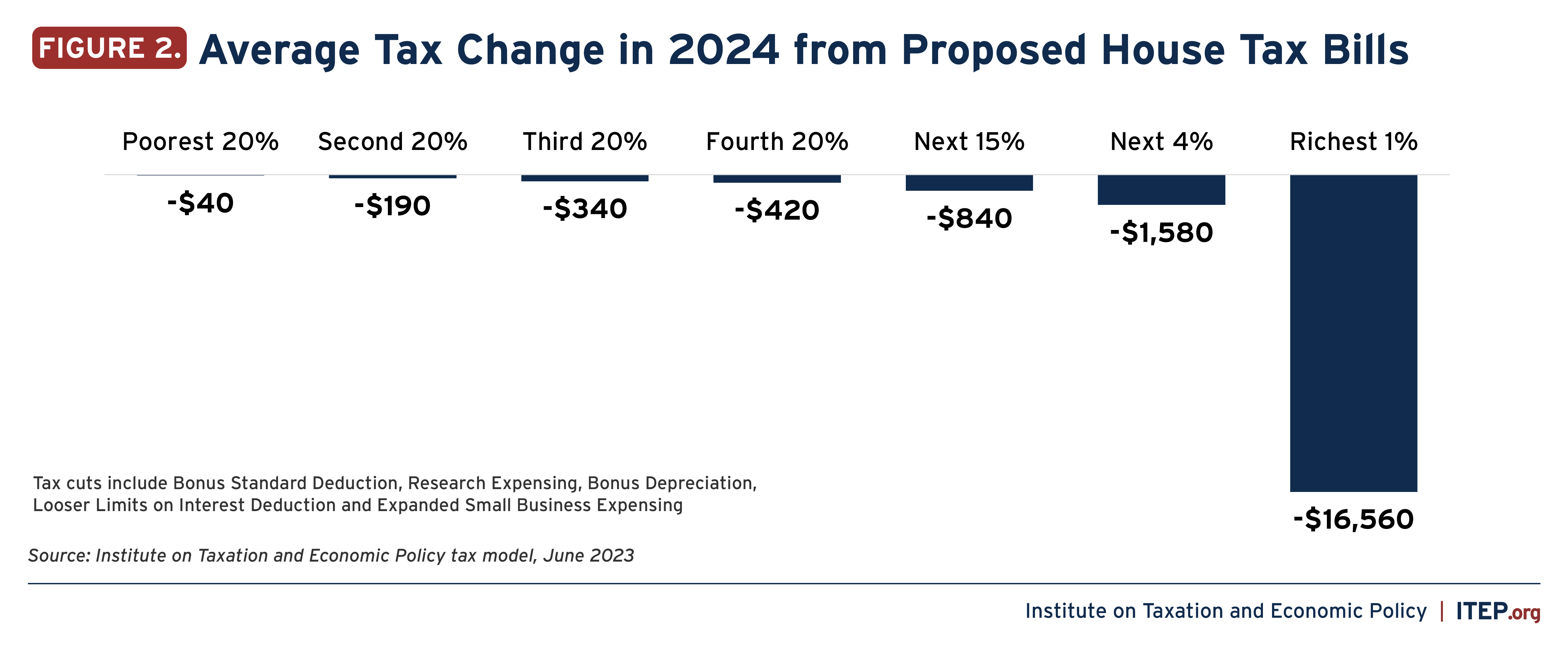

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Increase Form USA Child Tax Credit 2024 Increase Form : Apply Online & Claim : Child Tax Credits offer a much needed boost and refund to countless Americans, worth up to $2000 but it isn’t available everywhere for 2024, so where can you get it? There are 14 o . People filing in 2024 are filing such as the child’s age, relationship with the claimant and income conditions. The credit can be claimed on the federal tax return (Form 1040 or 1040-SR .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)